MNI EUROPEAN MARKETS ANALYSIS: China Q1 GDP Beats, But March Data Points To Slowing Momentum

- Regional Asia Equity sentiment has weakened today. Higher US yields, Middle East concerns and mixed China data have all weighed. Q1 GDP beat, but March data was weaker than expected in terms of IP and retail sales. The USD has pushed higher, with AUD and NZD hitting fresh YTD lows.

- A number of USD/Asia FX pairs have also made fresh multi year highs, which has seen fresh central bank intervention.

- Looking ahead, the Fed’s Powell (1815 BST), Jefferson, Williams, Barkin and Collins appear, as well as BoE’s Bailey and BoC’s Macklem. There are also US March housing starts/permits, IP & April NY Fed services, UK labour market and Canadian March CPI data. The IMF is due to publish the April World Economic Outlook.

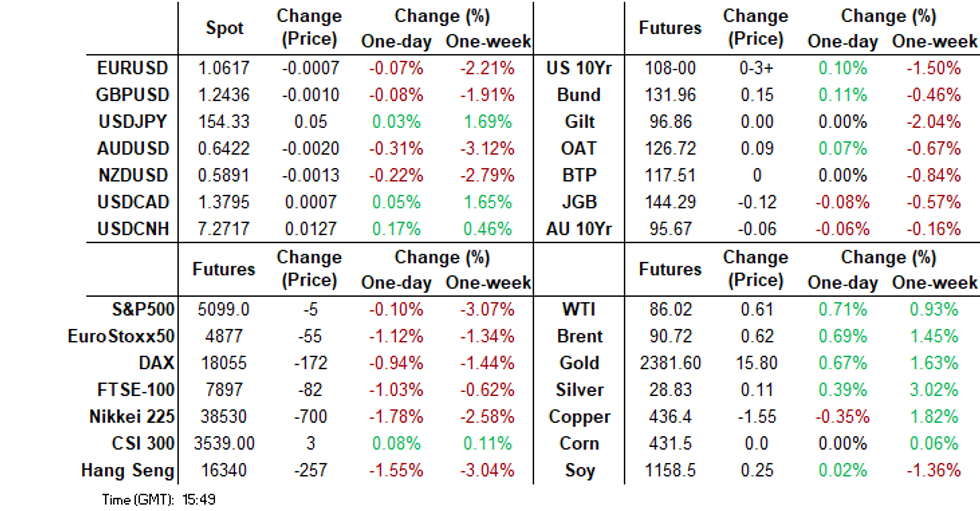

MARKETS

GLOBAL: Markets Wary As Israel Vows To Respond

Despite significant pressure for restraint, Israel has apparently decided on a “forceful” response but in a way that won’t escalate tensions in the region as it is designed to avoid casualties. It may include a cyber attack or a strike on a target in Tehran, according to the Washington Post. With Iran promising to retaliate “within seconds” though, the risks are still very elevated and oil markets wary.

- Israel’s war cabinet said that an attack of that magnitude can’t go unanswered with defence minister Gallant expressing that “Israel won’t accept an equation in which Iran responds with a direct attack every time Israel strikes targets in Syria”. He also told US defence minister Austin that Israel has no choice given Iran’s use of missiles.

- The timing of a response is unclear but war cabinet minister Gantz already said that it will be when the time is right.

- The UN will halt inspections of Iranian nuclear facilities given the risk of an Israeli strike, according to The Australian.

- Iran has been clear with its threats saying that any attacks on its people or assets would be met with an immediate response rather than waiting. The Speaker of the Iranian Parliament’s National Security Commission Amouei warned it would use “a weapon it has never before used”.

- Iran says that it is going to be tough on Israel but as it achieved its goal on the weekend, it views the issue “concluded” unless Israel retaliates.

- China spoke with Iran and has agreed that Iran’s response was limited and it has the right to self-defence given the attack on its embassy. It believes that Iran will avoid “further instability”.

GLOBAL SHIPPING: Shipping Risks Persist, Rates Rose Last Week

Shipping rates rose last week with both the Baltic dry and FBX global container indices rising to their highest since April 1. Iran’s seizure of an Israeli cargo vessel in the Strait of Hormuz on the weekend plus an increase in tensions in the Middle East are likely to support shipping rates. While unlikely, the closure of the Strait remains a risk. In MNI Supply Chain Index Not Yet Impacted By Threats To Shipping, we note that disruptions to vessels don’t appear to be impacting supply chains and while costs have risen they are well below pandemic peaks and already off their 2024 highs.

- The decline in shipping rates from the extremes of 2021 has been an important driver of lower global inflation. While shipping costs are not looking materially inflationary at this stage, they are also not going to provide further help in returning inflation to target.

Source: MNI - Market News/Refinitiv

- The FBX container index rose 2.1% last week to be up 87.5% year to date, after two consecutive weekly drops. In early February, it was up 157.6% YTD, and so has eased considerably since then.

- The China/East Asia to Mediterranean route rose 4.7% w/w to be up almost 85% YTD but it is still 36% off its mid-January peak and this region is particularly impacted by threats to shipping in the Middle East.

- China/East Asia to the east coast of North America rates fell 1.1% last week, the ninth straight decline, to be up 69% this year. The index peaked in early February.

- The Baltic Dry Index rose 6.2% last week but is 17.4% lower than the end of 2023.

Source: MNI - Market News/Refinitiv

US TSYS: Tsys Futures Steady, Fed's Daly Says No Urgency To Cut

- Treasury futures have been relatively stable on Tuesday, as Asian Equities and FX sell off during the session. There have also been a few block steepener trades going through. The 10Y contract trades at 107-30+ (+ 02) from NY closing level, after earlier making a high of 108-04 and we still comfortably hold above initial support at 107-16+ (2.50 proj of Dec 27 - Jan 19 - Feb 1 price swing), while to the upside resistance holds at 108.25+ (Apr 12 high).

- Cash Treasuries have done very little today with yields flat to 1bps higher the 2Y yield +0.5 at 4.925%, 10Y +0.8bp to 4.610%, while the 2y10y is unchanged at -31.975

- Across the local markets curves are following UST and bear steepening with ACGBs yields 2-6bps higher, NZGBs are 5-8bps higher, while in the EM space INDON 10Y rose to highest levels since November at 6.82%

- Projected rate cut pricing recedes: May 2024 at -4.7% w/ cumulative -1.2bp at 5.317%; June 2024 at -19.8% vs. -22.6% (compares to -55.1% pre-CPI) w/ cumulative rate cut -6.1bp at 5.286%. July'24 cumulative at -14.4bp vs -16.9bp earlier, Sep'24 cumulative -25.9bp vs. -28.8bp.

- (MNI) MNI BRIEF: Fed's Daly Reiterates No Urgency To Cut Rates (See link)

- Looking ahead: Building Permits, IP/Cap-U, and Fed Speak with Chairman Powell moderating a Q&A session with BoC head Macklem.

JGBS: Slightly Cheaper, Trade balance Data Tomorrow Alongside BoJ Rinban Operations

JGB futures are holding weaker but sitting in the top half of today’s range, -15 compared to the settlement levels.

- There hasn’t been much in the way of domestic drivers to flag. An Enhanced-Liquidity Auction of 5-15.5-year JGBs is due later.

- The BoJ is concerned the soft yen could weaken the wage-price relationship (See MNI Policy MainWire)

- (Bloomberg) -- Japan’s finance minister stopped short of issuing his strongest warning on possible market intervention in comments that fueled renewed yen weakness after the currency slumped to a fresh 34-year low overnight. (See link)

- Cash US tsys are ~1bp cheaper in today's Asia-Pac session after yesterday's sell-off. Fed Chair Powell, Vice Chair Philip Jefferson and Richmond Fed President Thomas Barkin are scheduled to speak later today.

- Cash JGBs are slightly cheaper across benchmarks. The benchmark 10-year yield is 0.6bps higher at 0.870% after setting a fresh YTD high of 0.884% earlier today.

- The swaps curve has twist-steepened, with rates 3bps lower to 1bp higher. Swap spreads are tighter across maturities.

- Tomorrow, the local calendar sees Trade Balance data alongside BoJ Rinban operations covering 1- to 25-year JGBs.

AUSSIE BONDS: Cheaper, Narrow Ranges, Local Calendar Light Until Jobs Data On Thursday

ACGBs (YM -5.0 & XM -6.0) are holding cheaper as trading remains confined within relatively narrow ranges during today's Sydney session. Given the light local economic calendar until Thursday's release of the March Employment Report, market participants have been closely monitoring movements in US tsy yields for guidance.

- Cash US tsys are dealing ~1bp cheaper in today’s Asia-Pac session after yesterday’s bear-steepening.

- Fed Chair Powell, Vice Chair Philip Jefferson and Richmond Fed President Thomas Barkin are scheduled to speak later today.

- (AFR) The Australian dollar hit a five-month low on Tuesday after more upbeat US economic data cast further doubt on whether the Federal Reserve can embark on interest rate cuts any time soon. (See link)

- Cash ACGBs are 4-6bps cheaper, with the AU-US 10-year yield differential +2bps at -29bps.

- Swap rates are 3-6bps higher, with the 3s10s curve steeper.

- The bills strip has bear-steepened, with pricing -1 to -5.

- RBA-dated OIS pricing is 3-4bps firmer for early 2025 meetings. A cumulative 18bps of easing is priced by year-end.

- Tomorrow, the local calendar sees the Westpac Leading Index, ahead of the Employment Report for March on Thursday.

- Tomorrow, the AOFM plans to sell A$800mn of 3% Nov-33 bond.

NZGBS: Closed Cheaper & Near The Session’s Worst Levels, Q1 CPI Tomorrow

NZGBs closed 5-8bps cheaper and close to the session’s worst levels ahead of tomorrow’s Q1 CPI. Consensus expects headline CPI to rise 0.6% q/q after 0.5% in Q4 to be up 4.0% y/y down from 4.7% helped by base effects (Q1 2023 rose 1.2% q/q). Non-tradeable inflation is expected to remain elevated at 1.3% q/q though up from 1.1%, while tradeables should again fall by 0.2% q/q.

- In February, the RBNZ projected a 0.4% q/q rise in Q1 CPI with the annual rate easing to 3.8% y/y. This is at the lower end of consensus expectations, which are between 0.4% and 0.8% q/q and 3.7% and 4.2% y/y.

- (Bloomberg) -- Weak business confidence is helping to ease inflation pressures, the Treasury Dept says in its Fortnightly Economic Update published Tuesday. (See link)

- (Bloomberg) Labor Productivity fell 0.9% in the year ended March 2023, the largest fall since 2009, which followed a rise of 1 per cent in the year ended March 2022, according to the statistics department Stats NZ. (See link)

- Swap rates closed 5-8bps higher, with the 2s10s curve steeper and implied swap spreads wider.

- RBNZ dated OIS pricing is little changed. A cumulative 38bps of easing is priced by year-end.

NZGBS: NZ-US 10Y Differential Narrows To Tightest Level Since Mid-2021

Today, the NZ-US 10-year yield differential has narrowed 5bps to +22bps, marking its tightest level since mid-2021. Previously, this differential had oscillated between +30 and +80 basis points since late 2022.

- In contrast, the NZ-AU 10-year yield differential stands at +52bps, positioning it within the midpoint of the range observed over the same period. Notably, the 12-month peak for this differential is approximately +100bps.

Figure 1: NZ-US 10-Year Yield Differential

Source: MNI – Market News / Bloomberg

FOREX: Dollar Higher, A$ & NZD Hit Fresh YTD Lows Amid Regional Equity Weakness

The BBDXY remains on the front foot, up a further 0.20% in the first part of Tuesday trade. Thie index last near 1264.3, is eyeing highs near 1266, levels last seen in mid Nov last week.

- Sharp falls in regional equities have likely aided USD sentiment. A number of key regional markets have fallen more than 2%. Higher US yields has weighed particularly on tech related sentiment. Cash tsy yields are a touch higher for US benchmarks, despite the risk averse tone emanating from equities.

- The USD/CNY fix also moved back above 7.1000, which kicked off a fresh round of USD gains, although USD/CNH has stabilized.

- China Q1 GDP was better than expected, but March activity figures point to loss momentum towards the end of the quarter, with IP and retail sales both notably sub expectations. Property related indicators also continued to show sharp double digit falls for the most part.

- AUD and NZD sit slightly above earlier fresh YTD lows, but both remain weaker by around 0.40%. AUD/USD got to 0.6408, but sits higher at 0.6415/20 in latest dealings. Regional equity risk aversion is weighing. A clean break sub 0.6400 opens up 0.6339, November 10 low.

- NZD/USD remains in a downward trend trading well below the 20, 50, 100 & 200-day EMA with the pair is trading back below 0.5900 at 0.5878 making new YTD lows and now looking to test 0.5864 (Nov 11 lows).

- The yen has outperformed, last near 154.30 in USD/JPY terms. We have had the familiar run of FX rhetoric/jaw boning, while the weaker equity backdrop has likely aided yen at the margins.

- Looking ahead, the Fed’s Powell (1815 BST), Jefferson, Williams, Barkin and Collins appear, as well as BoE’s Bailey and BoC’s Macklem. There are also US March housing starts/permits, IP & April NY Fed services, UK labour market and Canadian March CPI data. The IMF is due to publish the April World Economic Outlook.

ASIA EQUITIES: China & HK Equities Lower, Mixed China Data, Small-Caps Plunge

Hong Kong and China equity markets are lower today, China Mainland equities are faring better than Hong Kong. It has been a busy morning for China economic data, with GDP coming in at 5.3% vs 4.8% expected, retail sales missed estimates coming in at 3.1% vs 4.8% expected, Industrial Production also missed coming in at 4.5% vs 6.0% and Property developer names fell as home prices continued to fall in March, adding pressure on authorities to step up efforts to support the embattled real estate market. While earlier China's small cap index the CSI2000 tumbled over 6% after the regulators pledged to be tougher on de-listing companies, while the CSI1000 was down 3% verses the large-cap CSI300 down just 0.60% at their worst, the difference in performance could also be linked to buying by the National team, who focus on large-cap indices.

- Hong Kong equities are lower today and continue to underperform China Mainland equities, the HSTech Index is now down 2.34% and has broken below the 3,400 level it had been trading above since early March. The Mainland Property Index is faring slightly better, down only 1.62% at 1,152 although just holding above an important support zone of 1,150, the index did break below here earlier this morning however has been able to get back above with a break and close below here opening up a move to all time lows of 1,075 made in January, the HSI is off 1.64%. In China, markets are digesting economic data, large cap indices are performing better than smaller-caps with the CSI300 down 0.43%, while the CSI1000 is down 2.33% and the CSI2000 down 2.20%.

- China Northbound saw 8.1b of inflows on Friday, with the 5-day average at -0.06billion, while the 20-day average sits at 0.43billion yuan.

- In the property space, Times China faces a winding-up petition filed by Hang Seng Bank for financial obligations totaling $173.2 million and HK$731.4 million, with the first hearing set for July 3. Despite this, Times China asserts that the petition doesn't signify the company's winding up and plans to oppose it while working with creditors on a restructuring plan. China Vanke plans to use a $18 billion asset package as collateral to secure new bank loans amid concerns about its ability to avoid default. The company discussed this strategy with analysts at an investor event, aiming to alleviate worries following a recent market downturn. Despite the company's efforts, details about the asset package or potential sales remain undisclosed, and Vanke's response caused a slight uptick in its shares and bond prices.

- (Bloomberg) PwC Denies Allegations in Anonymous Letter on Evergrande Work (see link)

- (Bloomberg) China Tells Iran Cooperation to Last Despite Attack on Israel - (see link)

- (MNI) MNI BRIEF: China Q1 GDP Stronger Than Expected At 5.3% - (see link)

- Looking ahead, after a busy day of economic data, there will little else until the 1 & 5-yr LPR on Monday, Hong Kong has Unemployment data due on Thursday.

ASIA PAC EQUITIES: Equities Head Lower As US Retail Sales Beat, Asian Currencies Lower

Regional Asian equities are lower today and have slid the most in eight months with the MSCI Asia Pacific Index down more than 2% as the uncertainty around what Israel will do remains, while US retail sales data rose last month by more than forecast, suggesting the Fed may not rush to lower rates which pushed up Treasury yields and boosted the dollar while local Asian currencies trade near their cycle lows, elsewhere Volatility has picked up with the premium for one-month put options to protect against a pullback in US equities hitting 19.23 the highest since October 2023

- Japanese stocks fell after strong US economic data rekindled concerns that the Federal Reserve will delay its interest rate cuts, damping investors’ demand for riskier assets. Investors also continue to monitor tensions in the Middle East. The yen remains under pressure, after surging to a new 34-year low against the USD overnight. The increasing risk that authorities in Tokyo may intervene in the market to stem the drop still lingers, after Japan’s finance minister warned that he’s ready to take all available measures in the foreign exchange market if needed. The Topix is down 2.21% while the Nikkei fares slightly worse down 2.26%

- South Korea’s Kospi has dropped over 2% and is now the worst performing market in the region today, with tech and EV battery sectors leading losses after strong US retail sales data and higher US Treasury yields. Earlier SK import prices fell 0.7% in March from a year ago, while export prices increased 2.6%. The KRW continues to fall and is now approaching 1,400 won which is also weighing on the local stock market. Foreign funds sell 348b won worth of Kospi equities in early trading, local funds also sell while retail investors buy, the Kospi is down 2.38%

- Taiwan equities are following regional markets lower today, there is very little local market news or data out for Taiwan, the market will largely be dictated by China data, global yields and global semiconductor prices. The Taiex is current down 2.86%

- Australian equities follow global markets lower with the ASX200 now down 1.80% as banks and mining stocks contribute the most to the mover lower, elsewhere the AUD continues to fall after mixed China data hurts futures growth, with the currency now down 0.28% at 0.6424 the lowest levels since Nov 2023.

- Elsewhere in SEA, New Zealand Equities are down 1.00%, Singapore equities are down 1.30%, Malaysian equities are 0.37% lower. Philippines equities are under some real pressure, the PSEi is now down 8.72% from recent highs made early April, after breaking support levels last week, the index is down another 1.70% today and has erased all yearly gains, Indonesia has returned from a 10-day break with yields surging, currency has plummeted and equities are down about 2%.

ASIA EQUITY FLOWS: Asian Equities See Foreign Investors Sell

- China equities reversed their large outflow from Friday with a 8.1b yuan inflow via the northbound connect, this could be linked to an announcement late Friday by China's State Council where they released new guidelines aimed at tightening stock listing criteria, improving corporate governance, and cracking down on illegal share sales in efforts to bolster the equity market. China Mainland equities significantly out-performed Hong Kong Equities with the CSI300 up 2.11% vs HS China Enterprise Index down 0.39%. the 5-day average is now -0.06b vs the 20-day at 0.43b and the 100-day at 0.41b yuan.

- Taiwan equities saw another day of outflows with a -$962m leaving the market marking the third straight day of selling by foreigners for a total of about $1.5b. The Taiex was down 1.38% on Monday, with the Israel and Iran conflict seen as a major driver of the move, and also failed to hold above 20,800 last week so a small correction could be in play before retesting those levels. The 5-day average is now $177m, vs the 20-day at -$268m both well below the longer term trend of $154m

- South Korea equities were slightly lower on Monday, although out-performed the majority of markets in the region. The market opened lower down about 1.5% earlier before simmering tensions in the middle east help push the market off it's lows, although the KRW and other Asian currencies hit cycle lower. Selling by foreign investors increased with a $221 outflow, taking the 5-day average to $156m, the 20-day average to $303m and the 100-day average to $186m.

- Philippines equities broke below the 6,800 mark Apr 5th, a level that had acted at support for the prior month or so, the PSEi is now off 7.13% from its highs made on Apr 2nd, and broke through the support zone of 6,600 on Monday. Equity flows have been negative for 7 straight days for a total of -$66m. The 5-day average is -$9m, the 20-day average is -$6.75m, while the $1.66m.

- India saw the largest outflow since Jan 17th and just the second largest outflow since June 2022 on Friday, the move could be related to, two failed attempts to break 22,800 on Tuesday and Thursday, with the Nifity 50 now off 2.16% since. Indian CPI also missed estimates late Friday coming in at 4.85% vs 4.90% expected. The 5-day average is now $114m vs the 20-day average at $110m both above the 100-day average of $90m

Table 1: EM Asia Equity Flows

| Yesterday | Past 5 Trading Days | 2024 To Date | |

| China (Yuan bn)* | 8.1 | -11.5 | 61.0 |

| South Korea (USDmn) | -221 | 839 | 14115 |

| Taiwan (USDmn) | -963 | -423 | 3181 |

| India (USDmn)** | -952 | 1374 | 1726 |

| Indonesia (USDmn) *** | 0 | -377 | 1102 |

| Thailand (USDmn) *** | 0 | 252 | -1666 |

| Malaysia (USDmn) ** | -44 | -103 | -336 |

| Philippines (USDmn) | -5 | -49.7 | 118 |

| Total (Ex China USDmn) | -2185 | 1511 | 18240 |

| * Northbound Stock Connect Flows | |||

| ** Data Up To Apr 12th | |||

| *** Close for Public Holiday |

OIL: Crude Climbs Higher On Tense Middle East

Crude has started today stronger rising around 0.5%, in response to Israel’s decision to retaliate to Iran’s attack and the latter’s threat to respond “within seconds”. Markets remain wary with a third of oil output coming from the region. Prices are off their highs made earlier in the day as China’s March data was mixed. Brent is up 0.5% to $90.58/bbl but rose to a high of $90.84 earlier. WTI is 0.6% higher at $85.91 after rising to $86.18. The USD index is 0.2% higher.

- Israel’s war cabinet said that an attack of that magnitude can’t go unanswered with defence minister Gallant expressing that “Israel won’t accept an equation in which Iran responds with a direct attack every time Israel strikes targets in Syria”.

- China’s March oil refining rose 1.3% y/y to a 5-month high as product stocks were rebuilt following the Lunar NY holiday. Processing should decline over April/May though for seasonal maintenance but low margins may exacerbate this.

- Geopolitics are currently driving oil prices but supply/demand fundamentals are always nearby. Demand in the US is expected to pick up to increase gasoline supplies for the driving season. Later today US inventory data from the API are released.

- Later the Fed’s Powell (1815 BST), Jefferson, Williams, Barkin and Collins appear, as well as BoE’s Bailey and BoC’s Macklem. There are also US March housing starts/permits, IP & April NY Fed services, UK labour market and Canadian March CPI data. The IMF is due to publish the April World Economic Outlook.

GOLD: Hovering Just Below Record High

Gold is 0.3% higher in the Asia-Pac session as geopolitical tensions in the middle east continued to drive safe haven demand. Bullion closed 1.7% higher at $2383.34 on Monday, just shy of its all-time high of $2431.50.

- According to MNI’s technicals team, the trend condition in gold remains bullish. The next objective is $2452.5, a Fibonacci projection. Initial firm support is at $2264.8, the 20-day EMA.

- (Bloomberg) Citigroup Inc. raised its 2024 gold estimate to $2,350 an ounce and made a “massive 40% upward revision” to its 2025 forecast to $2,875, it said in a note. That came after Goldman Sachs Group Inc. said Friday the metal was in an “unshakable bull market,” raising its year-end prediction to $2,700.

- Meanwhile, silver outperformed on Monday, rising by 3.1% to $28.7/oz. This brought the gold/silver ratio down further, to its lowest level since early December.

ASIA FX: A Number Of USD/Asia Pairs At Multi-Year Highs, Regional Equity Sentiment Weaker

Most USD/Asia pairs have seen strong gains amid broad USD strength and slumping regional equity sentiment. The higher USD/CNY fixing was also a factor, although CNH losses remain modest amid tighter liquidity. Some pairs touched fresh highs going back a number of years. USD/KRW got to 1400, USD/TWD rallied through 32.5. USD/IDR is above 16100, while USD/PHP touched 57.00. A number of central banks/finance ministries were on the wires talking about curbing excessive volatility or stating they were intervening.

- USD/CNH got to fresh highs of 7.2830 post the higher onshore fixing (back above 7.1000). However, we sit back sub 7.2700 in recent dealings, only around 0.155 weaker. Tighter liquidity is raising short CNH costs. USD/CNY spiked above 7.2400 at the open but reportedly met state bank offers. We were last back at 7.2375, little changed for the session. Q1 China GDP beat estimates, but the March activity figures point to a loss of momentum as we progressed through the quarter. Property related indicators also remain soft.

- Spot USD/KRW touched a high of 1400, but we sit back lower at 1395/96 currently, still 0.80% weaker. The South Korean FinMin stated they are ready to curb excessive volatility in financial markets. The Kospi is down sharply, off more than 2%, as tech equities are weighed by higher US yields and Middle East tensions. The 1 month NDF was last near 1394.

- Spot USD/TWD has broken higher, the pair above 32.50, levels last seen in 2016. Like the won, TWD is suffering from weaker tech sentiment and firm US yield backdrop.

- Indonesian markets have returned from an extended break, with today the first trading session since Apr 5. Spot USD/IDR has surged, up over 2%, to be tracking around 16165 in recent dealings This is fresh highs in the pair back to Apr 2020. Note in March of that year the pair peaked at 16625. Rupiah weakness largely reflects catch up to USD gains/higher yields while onshore markets were shut. Not surprisingly, headlines have crossed with BI stating it has intervened in the spot and domestic NDF markets. It also plans to offer higher SRBI yields to attract offshore inflows (BBG).

- USD/PHP tested 2023 highs at 57.00, but hasn't had a convincing breakthrough. BSP Governor Remolona was on the wires stating that 57.00 is not a firm line in the sand and that the central bank has changed its intervention strategy from previous years. He added tensions with China in the South China Sea are a PHP headwind.

Indonesia: Indon Sov Yields Higher, FX above 16,000, Consumer Confidence Rises

Indonesian has returned from their 10-day break and yields have surged higher, the INDON Sov Debt curve has bear-steepened with yields 3-15bps higher. Earlier Consumer Confidence Index increased slightly in March to 123.8 up from 123.1 in Feb, the IDR has fallen past 16,000 for the first time since April 2020, with the central bank saying it had intervene in the spot and domestic NDFs markets.

- The INDON sov curve has bear-steepened on Tuesday as local markets returned with the 2Y yield 2bp higher at 5.215%, 5Y yield is 4.5bps higher at 5.275%, the 10Y yield is 13bps higher at 5.42%, while the 5-year CDS is 4bps higher at 80.50bps and at the highest levels since mid Nov 2023.

- The INDON to UST spread has widen over the past week with the 2yr now 29bps, 5yr is 64.5bps, while the 10yr is 81bps.

- In cross-asset moves, the USD/IDR is 2.14% higher at 16,184, the JCI is 1.84% lower, Palm Oil is 0.69% lower, while US Tsys yields are mostly unchanged

- (BBG) Bank Indonesia Intervenes as Rupiah Weakens Beyond 16,000 (See link)

- (BBG) Indonesian Bonds to Be Supported by Domestic Investors: OCBC (See link)

- Looking ahead: Local Auto Sales and External Debt later this week

INDONESIA DATA: Consumer Confidence Continues To Point To Solid Consumption

March consumer confidence rose 0.6% m/m to 123.8, less than a point below the 12 month average. It has been fairly stable for the last 18 months and continues to point to solid private consumption growth, which was at 4.5% y/y in Q4. Bank Indonesia (BI) said at its March meeting that household expenditure is one of the drivers of “solid” national growth.

- USDIDR has weakened significantly to above 16100 prompting BI to intervene again in the FX market today. However, the JP Morgan NEER is 1% higher this year, which should keep downward pressure on import prices and support consumption. While import prices are not as low as they were in mid-2023 (July -11.4% y/y), they still fell 1.7% y/y in February.

- Q1 national accounts are released on May 6, which should give a more complete picture of domestic demand. The next BI meeting is on April 24 though and its assessment of consumption is unlikely to change before the Q1 data prints.

Source: MNI - Market News/Refinitiv

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 16/04/2024 | 0600/0700 | *** |  | UK | Labour Market Survey |

| 16/04/2024 | 0800/1000 | ** |  | IT | Italy Final HICP |

| 16/04/2024 | 0900/1100 | *** |  | DE | ZEW Current Conditions Index |

| 16/04/2024 | 0900/1100 | *** |  | DE | ZEW Current Expectations Index |

| 16/04/2024 | 0900/1100 | * |  | EU | Trade Balance |

| 16/04/2024 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 16/04/2024 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 16/04/2024 | 0915/1015 |  | UK | BOE's Lombardelli TSC pre-appointment hearing | |

| 16/04/2024 | 1215/0815 | ** |  | CA | CMHC Housing Starts |

| 16/04/2024 | 1230/0830 | *** |  | CA | CPI |

| 16/04/2024 | 1230/0830 | *** |  | US | Housing Starts |

| 16/04/2024 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 16/04/2024 | 1300/0900 |  | US | Fed Vice Chair Philip Jefferson | |

| 16/04/2024 | 1315/0915 | *** |  | US | Industrial Production |

| 16/04/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 16/04/2024 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 16/04/2024 | 1630/1230 |  | US | New York Fed President John Williams | |

| 16/04/2024 | 1700/1800 |  | UK | BoE's Bailey Interview On IMF Today | |

| 16/04/2024 | 1700/1300 |  | US | Richmond Fed's Tom Barkin | |

| 16/04/2024 | 1715/1315 |  | US | Fed Chair Jerome Powell | |

| 16/04/2024 | 2000/1600 |  | CA | Canada federal budget | |

| 17/04/2024 | 2245/1045 | *** |  | NZ | CPI inflation quarterly |